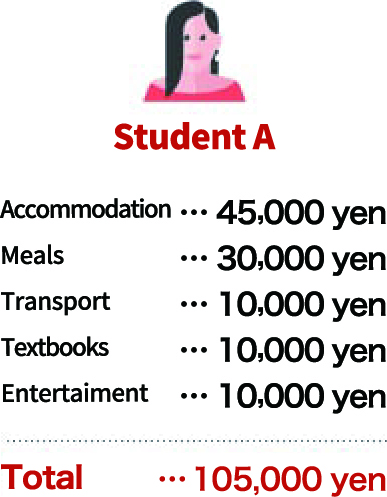

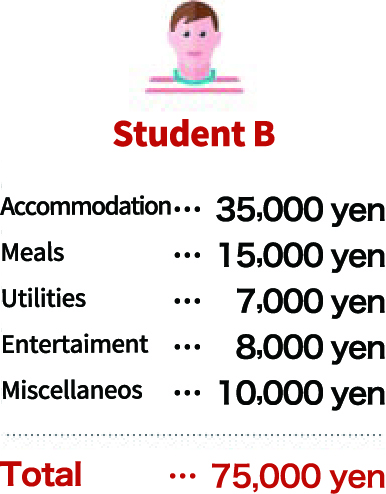

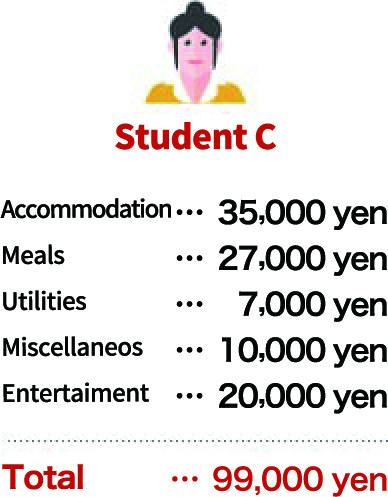

Example comparison of the expenditures of boarding students in Kyoto

● Example comparison of the expenditures of boarding students in Kyoto

●International student`s Average Expenses (in the Kinki Region)

- □ Average monthly income : Part-time work 56,000 yen

- □ Average monthly expenditures : Accommodation 37,000 yen, Meals 26,000 yen

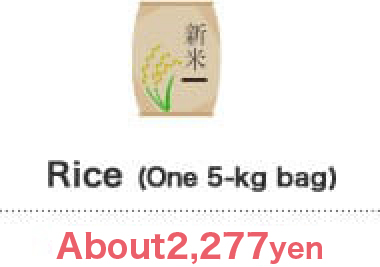

Reference: 2021 Retail Price Survey (Trend Survey) by the Statistics Bureau, Ministry of Internal Affairs and Communications

Average retail prices

Reference: 2022 Retail Price Survey (Trend Survey) by the Statistics Bureau, Ministry of Internal Affairs and Communications

About taxes

Tax payment is an obligation in Japan The following are the main taxes most likely to concern international students.

Consumption tax

A rate of 10% is imposed on the payment amount when buying a product or receiving a service. However, food, newspapers and other specific item apply for a reduced tax rate of 8%. The price may be indicated as tax-inclusive, in which case the consumption tax is already included in the price, or it may be indicated as tax-exclusive, in which case the consumption tax is not included and charged separately instead.

Income tax (for those doing part-time work)

Tax imposed by the country on personal income. Income tax is deducted from the monthly salary. A fixed tax rate is applied to the amount remaining after deducting various deductibles from the total income in 1 year to determine the tax amount.

● Year-end adjustment

The tax amount deducted each month from the monthly income and the tax for the total income in a year may not necessarily be the same. Therefore, a “year-end adjustment” is carried out to settle any excess or shortage. The procedure will be carried out by your company so check with your superior at the place where you work part-time.